Progressive tax rates help ease tax bite on income increases, minimum wage or otherwise - Don't Mess With Taxes

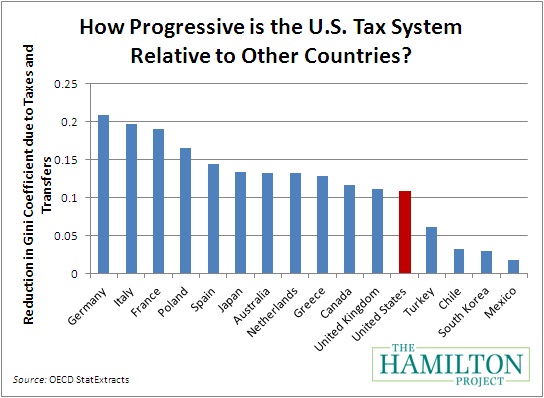

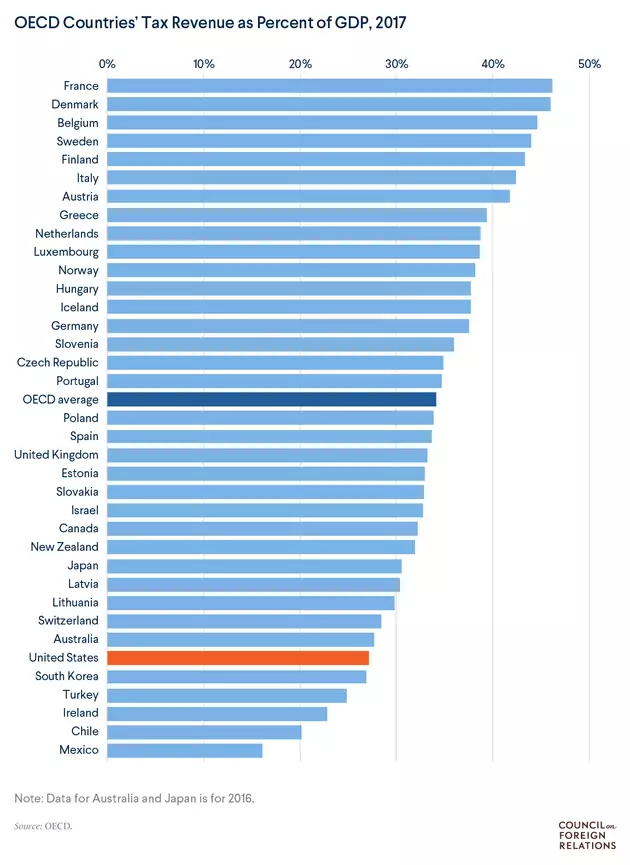

Tax Shares Paid by the Rich: Does the U.S. Have the Most Progressive Tax--Not Tax and Transfer, But Tax--System in the OECD?: For the File Weblogging

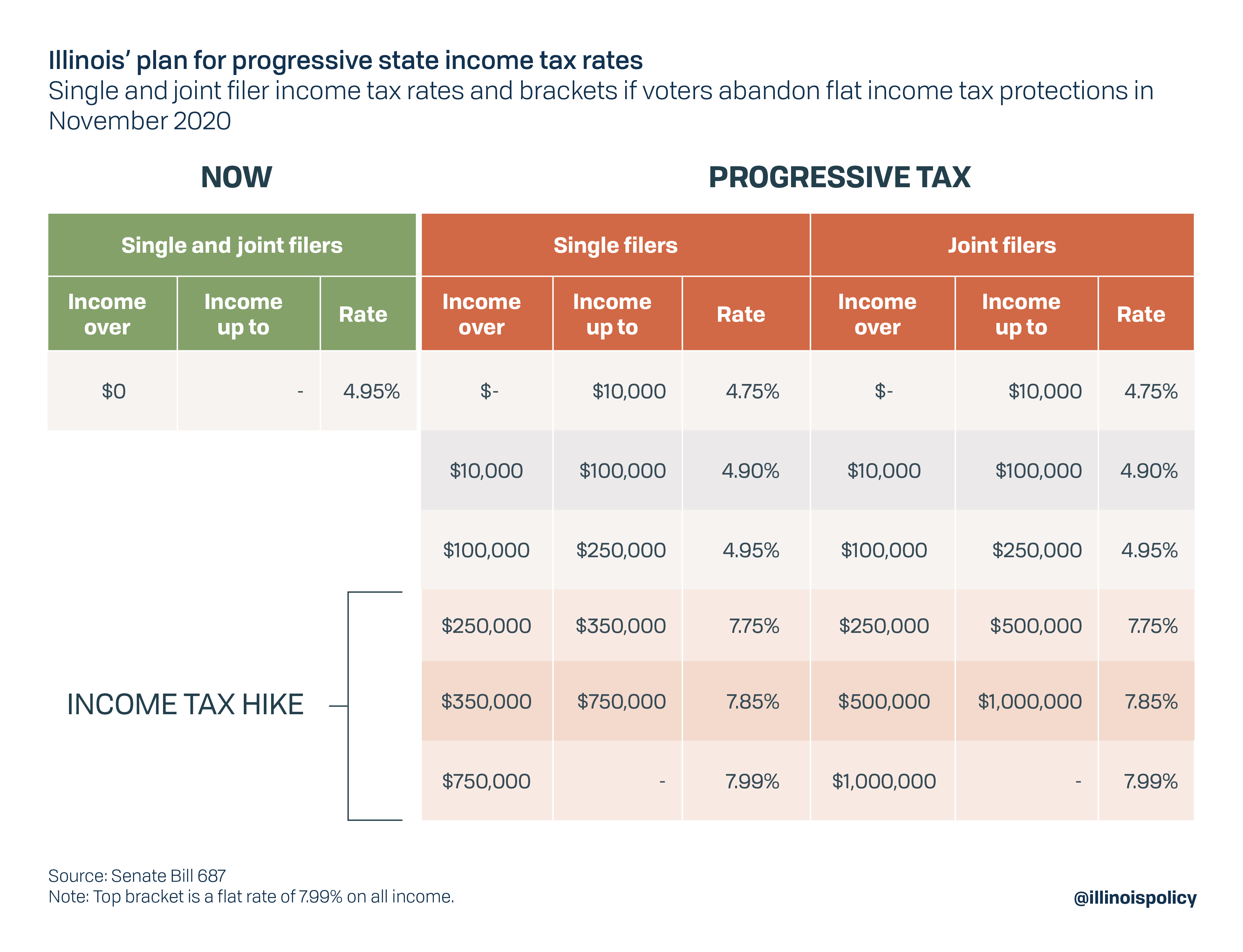

Progressive or punishing? Is Illinois' proposed progressive tax as fair as other states? - Center for Illinois Politics

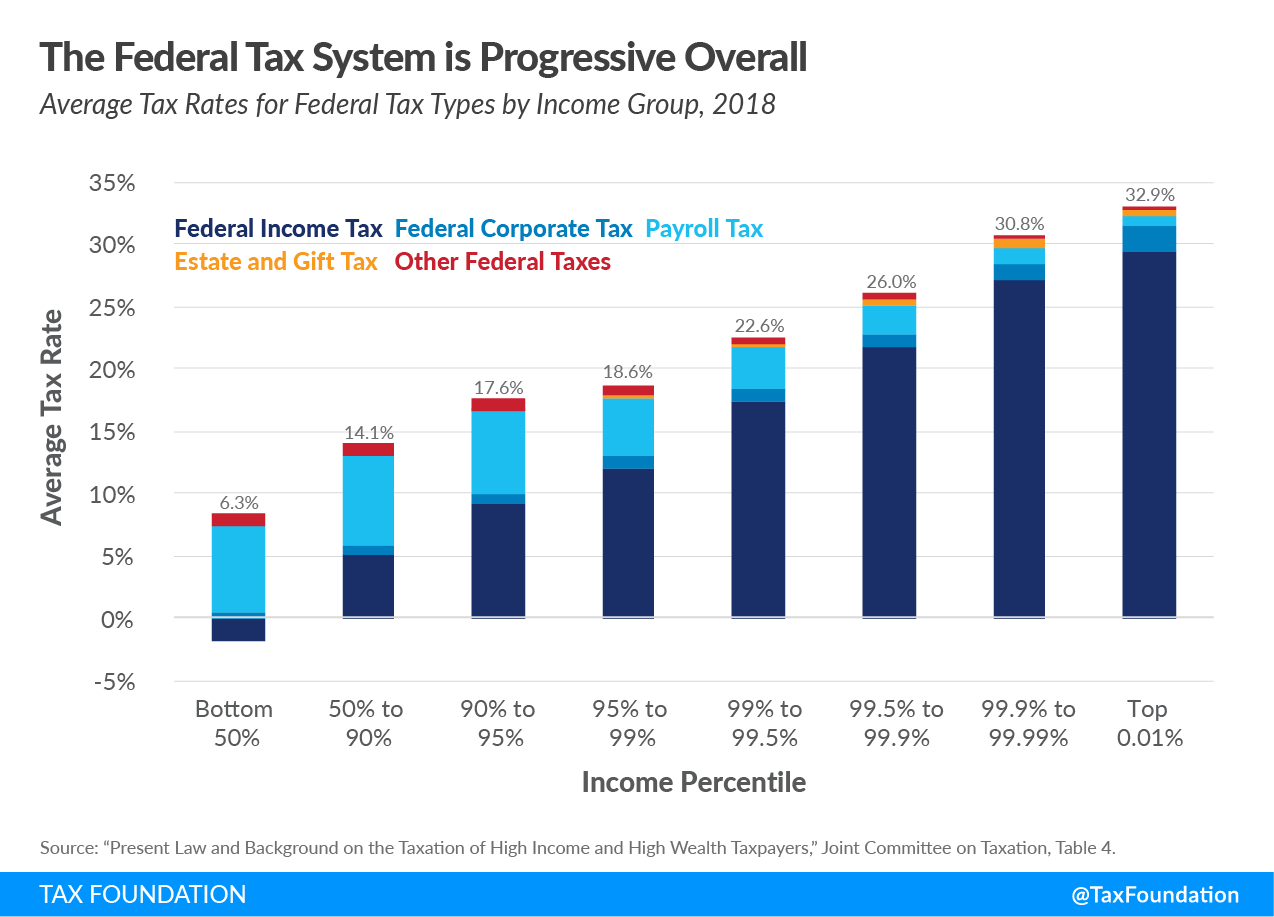

U.S. federal income tax structure "most progressive" in the world, more than offsets regressively of state/local taxes - Opportunity Washington

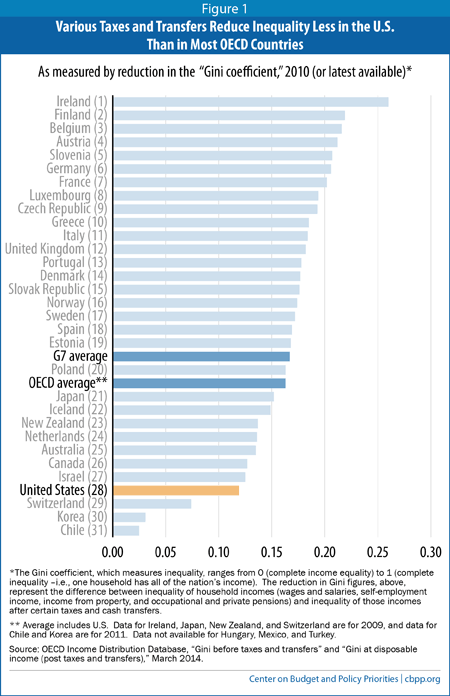

What Do OECD Data Really Show About U.S. Taxes and Reducing Inequality? | Center on Budget and Policy Priorities